Tuesday, July 1, 2025

3PL Spotlight: July 2025

Hello July!

July’s spotlight dives into key insights shaping today’s logistics and supply chain landscape. From managing conflict in family businesses to boosting warehouse flexibility and understanding rising cargo theft trends, this month’s content equips you with practical strategies and the latest industry updates. Stay informed and ahead with expert perspectives and actionable advice to navigate an evolving market.

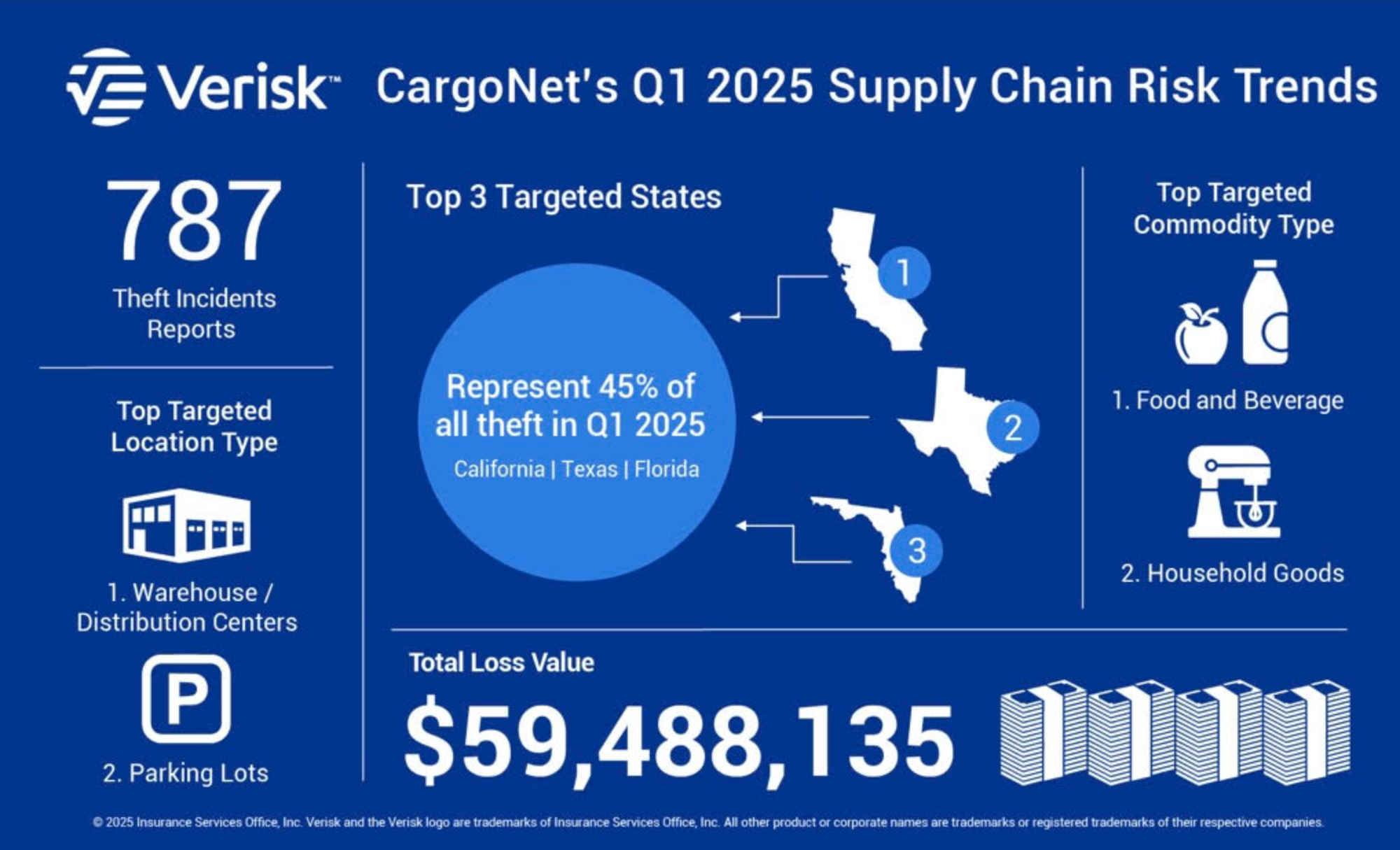

Q1 2025 Cargo Theft Trends

Over $63M in goods were stolen in Q1 2025, with sharp increases in copper, meat, and beverage theft. Criminals are favoring digital scams like business email compromise, and equipment theft is on the rise. California tops the list of hotspots, and thefts spike on Fridays.

Best Practices for Working with 3PLs

Effective partnerships with third-party logistics providers (3PLs) hinge on clear communication, mutual understanding, and realistic expectations, especially regarding automation capabilities. Experts emphasize the importance of cultivating strong relationships, setting clear objectives, and maintaining transparency in day-to-day operations. Tailoring solutions to the unique needs of each business, rather than adopting a one-size-fits-all approach, is crucial for success. Additionally, being realistic about the capacities of automation ensures that expectations align with the 3PL's capabilities, leading to more effective and sustainable partnerships.

Understanding Bonded Warehouses and Foreign Trade Zones

Bonded warehouses and Foreign Trade Zones (FTZs) are strategic tools for importers aiming to defer duties and manage tariffs effectively. Bonded warehouses allow goods to be stored without immediate duty payments until they enter the U.S. market, offering cash flow flexibility. FTZs, on the other hand, enable goods to be stored, assembled, or manufactured without paying customs duties until they are withdrawn, potentially reducing costs through inverted tariffs.Both options are gaining prominence as businesses seek to navigate evolving trade policies and mitigate tariff impacts.

Realizing the Generative AI Opportunity

A recent survey by Harvard Business Review Analytic Services, sponsored by AWS, reveals that 83% of business leaders believe neglecting generative AI (gen AI) will result in falling behind competitors. Despite recognizing its importance, only 48% feel prepared to adopt gen AI. Key barriers include ethical, legal, and cybersecurity concerns (56%) and a lack of clear implementation strategies (50%). Organizations are addressing these challenges by developing governance frameworks, enhancing data infrastructure, and ensuring human oversight of AI outputs. The survey underscores the urgency for businesses to embrace gen AI to enhance productivity, innovation, and competitiveness.

From Warehouse to Boardroom

In a thought-provoking article, Thomas Law, DBA, explores how logistics is no longer just a back-end operation—it’s becoming a critical part of executive strategy. As supply chains grow more complex and disruptions more frequent, logistics professionals are being called to the boardroom to help shape long-term business goals. Law argues that those who understand both the warehouse floor and the business vision will be the leaders who drive future innovation and resilience. Read the full article by Thomas Law on LinkedIn below.

2025 State of Logistics: Executive Snapshot

The global logistics landscape in 2025 is marked by contrasting economic conditions. The United States and Europe are experiencing slower growth, while Asia and Africa continue to expand steadily. Trade policies, tariffs, and emerging technologies like AI are shaping supply chains worldwide. Air freight growth is slowing, with shifting regulations and e-commerce trends influencing demand. Parcel and last-mile delivery are split between fast, premium services and slower, low-cost options, as major players like Amazon increase their logistics capabilities. Third-party logistics providers are evolving rapidly, integrating automation and data analytics to improve efficiency and meet rising customer expectations.

Freight forwarding is being reshaped by mergers, AI-driven automation, and a push for nearshoring, despite challenges in reshoring execution. Ocean freight faces a supply-demand imbalance that will likely lower rates, while sustainability and technological innovation remain key focuses for carriers. Motor carriers face uncertainty due to tariffs and rising costs but look to AI and autonomous vehicles for solutions. Railroads are investing in infrastructure and partnerships to boost growth and convert truck freight to rail.

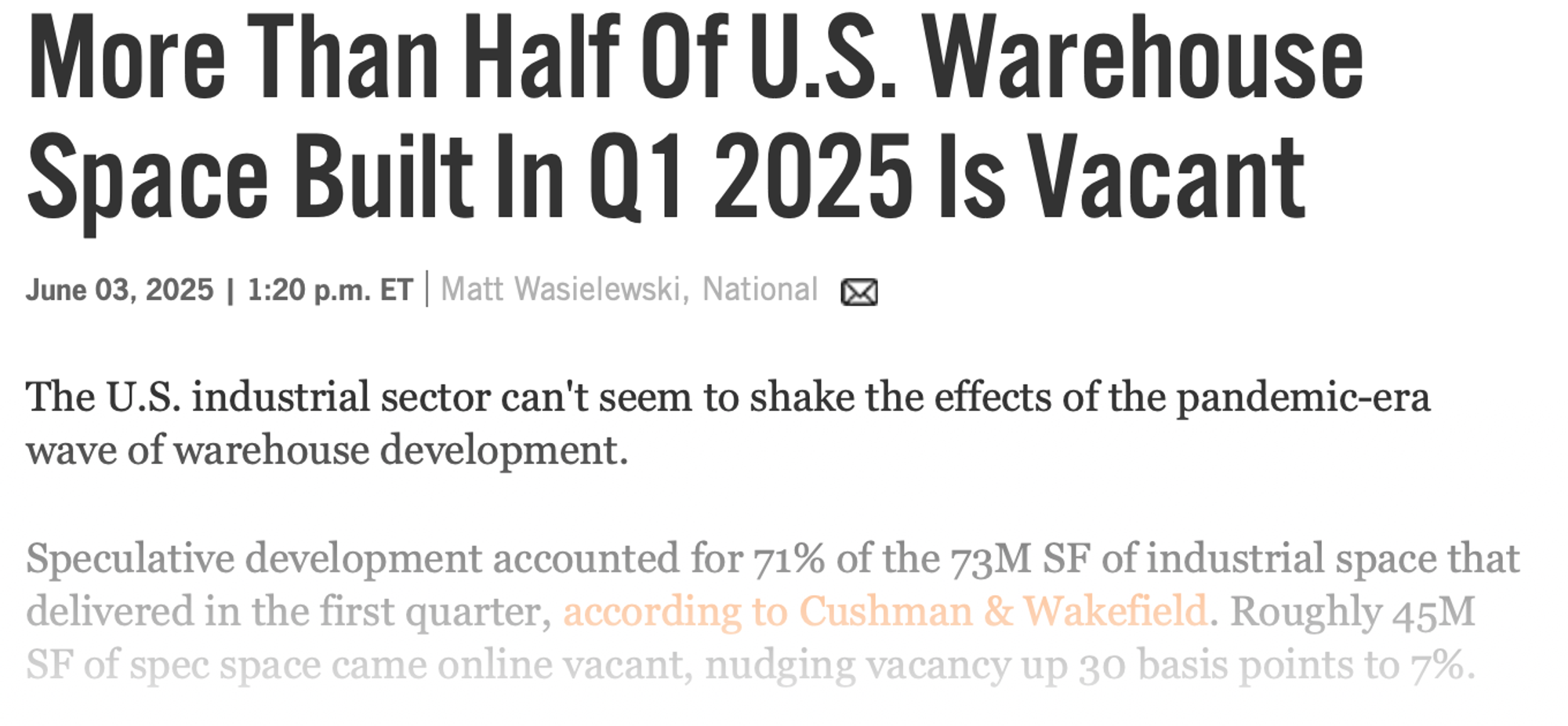

Warehousing sees rising vacancy rates and slower construction, with automation and AI helping to improve labor productivity and inventory management. Sustainability efforts vary globally, with Europe leading and the U.S. adopting a more pragmatic, ROI-focused approach. Supply chain network strategies are shifting from reactive fixes to continuous redesign, emphasizing resilience, flexibility, and growth, while nearshoring and mergers remain important factors.

Interview - CRESA

Navigating the Warehouse Market for 3PL Success

Third-party logistics providers recognize the critical role that real estate plays in their success, and Cresa stands out as a key partner. With the right facility, the right location, and at the right time and cost, 3PLs can gain a competitive edge. 3PL-Rx recently spoke with Eric Zahniser, Managing Principal and Co-Chair of Cresa’s Industrial & Logistics practice group, who highlighted the firm’s Blue Chip Labor Analytics technology—an internal supply chain consulting group for network optimization with transportation costs as the top priority. Cresa provides end-to-end real estate advisory services and helps 3PLs secure the best warehouses, maximizing tenant favorability of rates and terms.

Importantly noted, there is no cost to the 3PL for Cresa’s representation, as landlords cover the commission. Amid ongoing economic uncertainty and tariff concerns, Cresa remains a trusted advisor for navigating logistics real estate decisions.

From Leverage to Leases: The 3PL Real Estate Catch-22

The industrial real estate landscape is evolving, revealing a new balance in

tenant-landlord dynamics. While landlords continue to uphold established leasing standards, market conditions have shifted significantly from pre-2023

expectations—particularly in over-leveraged regions like California, Phoenix,

Indianapolis and New Jersey. Tenants with strong credit operate in a favorable

environment, benefiting from stabilized or improved rates and generous concessions, as landlords grow increasingly sensitive to credit risk following lease defaults by weaker tenants. For 3PLs, however, it’s a catch-22: real estate conditions are prime, but many can’t capitalize due to diminished demand and underutilized facilities as inventory and factory orders decline. The e-commerce shakeout has led to a wave of consolidations and defaults, prompting some 3PLs to pursue M&A or sell off accounts. Meanwhile, brands are asserting greater control over real estate selection and negotiation, yet still expect 3PLs to hold the lease, often with added flexibility, such as lease assumption rights. In oversupplied markets like South Jersey, landlords are increasingly open to demolishing large spaces despite single-tenant buildings typically being more valuable. These shifts are creating structuring opportunities, where strategic partnerships, subleases, or the displacement of underperforming operators can unlock win-win outcomes across the board.

Lease Fast, Merge Smart

Timing is everything in today’s logistics real estate market. Strategic partnerships with 3PLs already occupying underutilized, fully racked facilities can accelerate project launches by five to six months, bypassing buildout and permitting delays. Legacy leases signed before 2020 often offer below-market rates, creating a cost advantage for savvy operators entering the space. As lease terms shift from traditional five-year commitments to more flexible three-year arrangements, landlords are reluctantly adjusting to meet demand. For 3PLs in a position to grow, now is the time to start. It is important for them to pursue space with higher specs and better access while concessions are strong. Additionally, M&A presents a critical path forward—whether through acquisition, merger, or strategic sale—as scale and branding increasingly define success in securing major contracts.

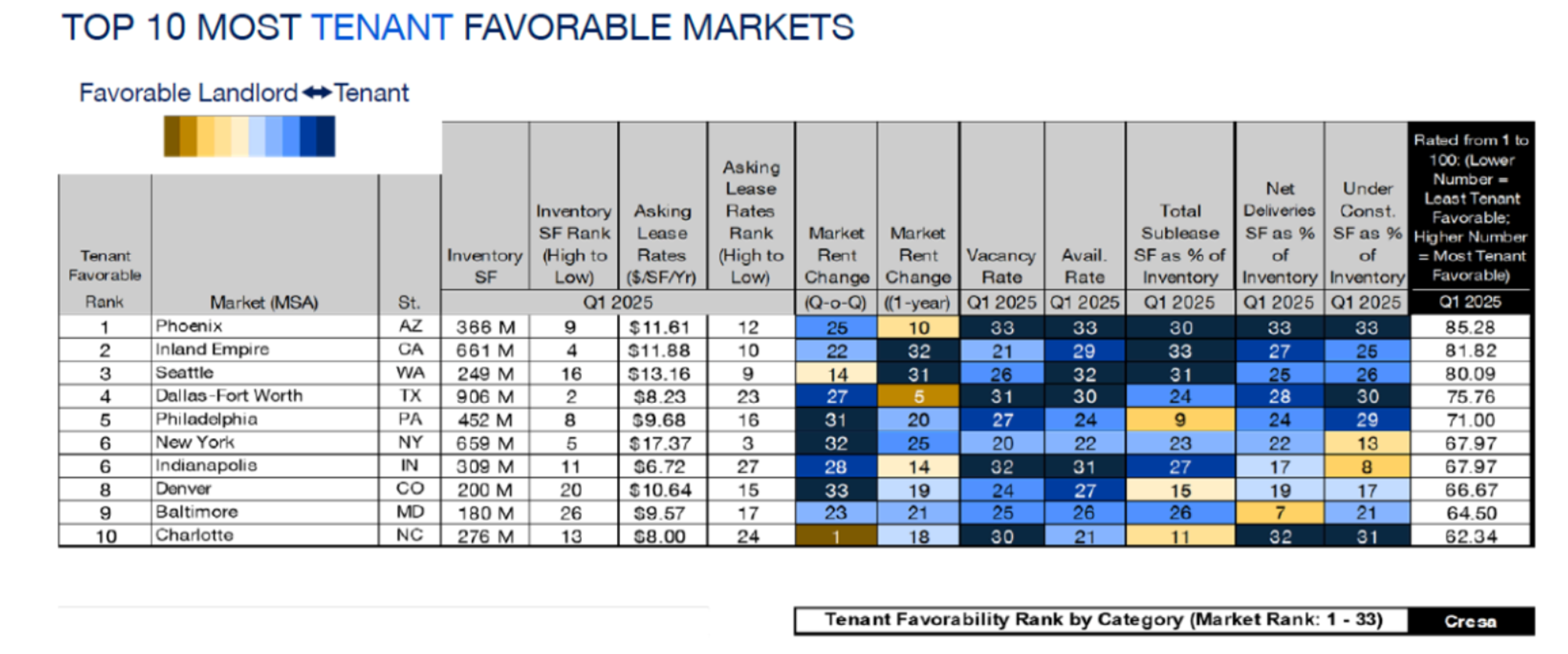

Cresa’s Spring 2025 Logistics Index highlights the 10 most TENANT favorable markets:

Webinars

Managing Conflict in Family Enterprises

Doug Baumoel breaks down why conflict in family businesses often runs deeper than simple disagreements. Learn how to spot identity-based conflict, avoid common missteps, and match the right support to the situation.

Flexibility on the Warehouse Front Lines

Join this 30-minute webinar hosted by Locus Robotics on July 16 to learn how top warehouse operators are using flexible automation to adapt to shifting labor, order volume, and space demands. Hear real-world lessons from industry leaders and discover how scalable robotics can drive efficiency across your network.

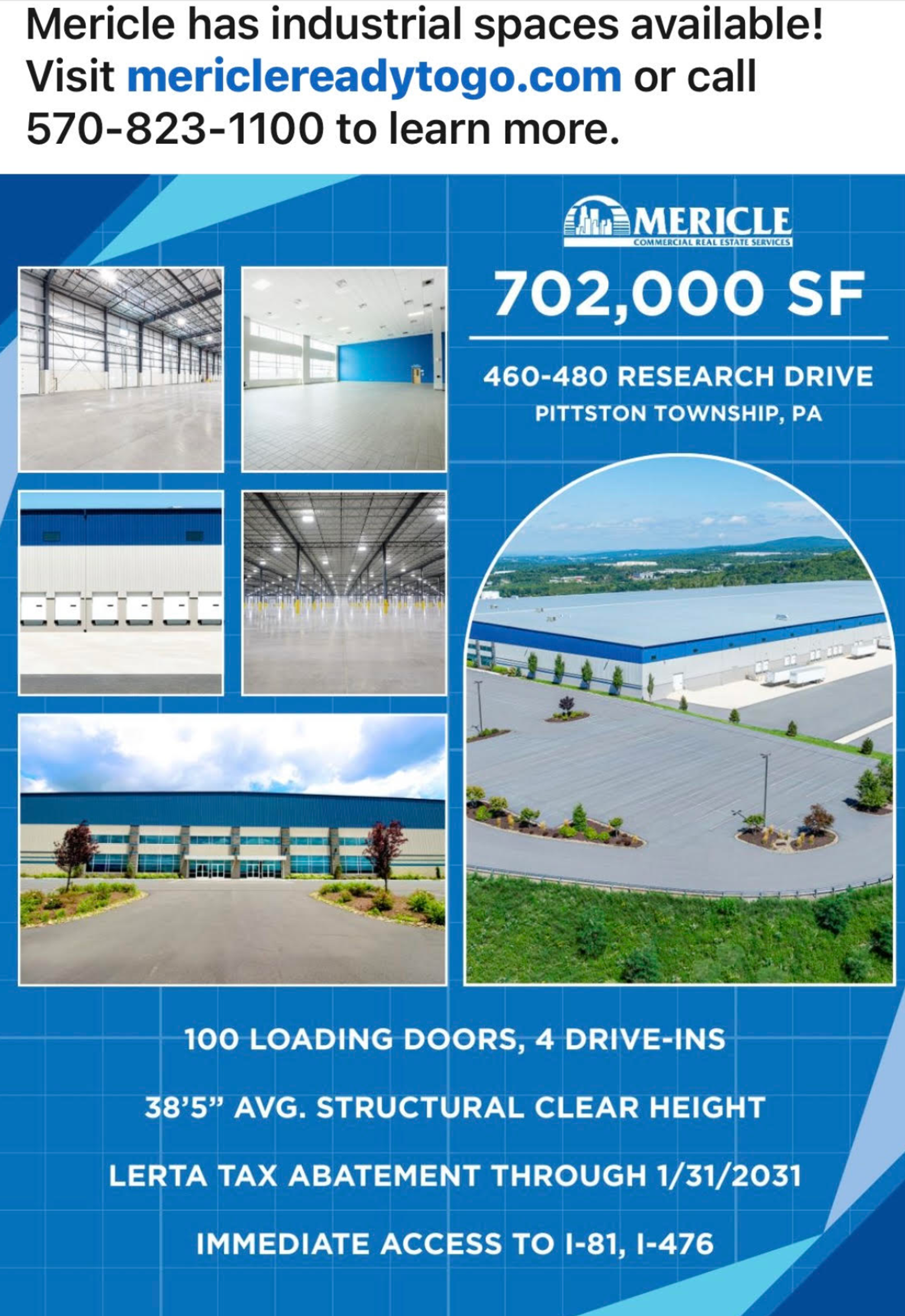

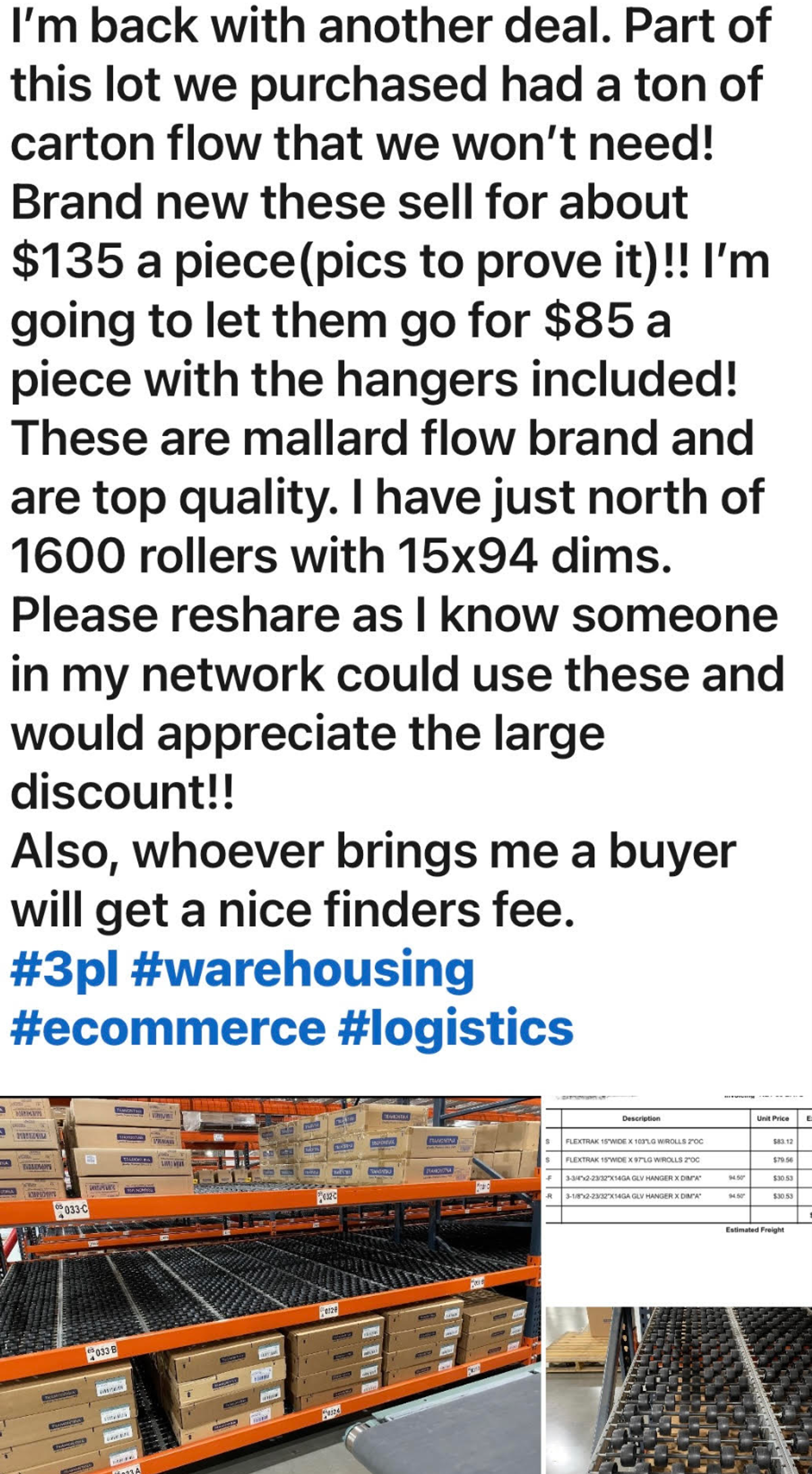

The X-Change Board

If any of these listings interest you or you'd like more information, please reach out to Chris Kane at @chriskane@3pl-rx.com or call 570-357-7788.

RACKING FOR SALE